Free Accounting Software join now!

Optimize Your Invoicing Process with the Best Invoicing Software

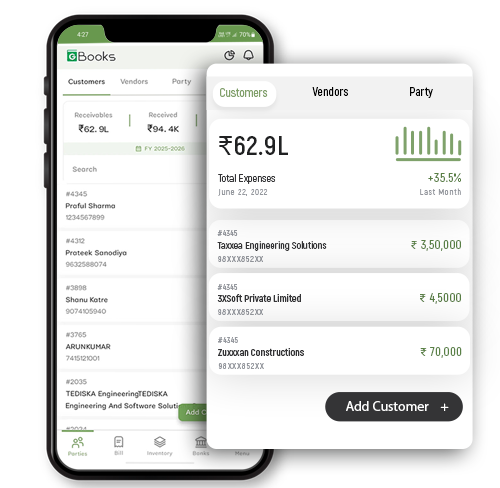

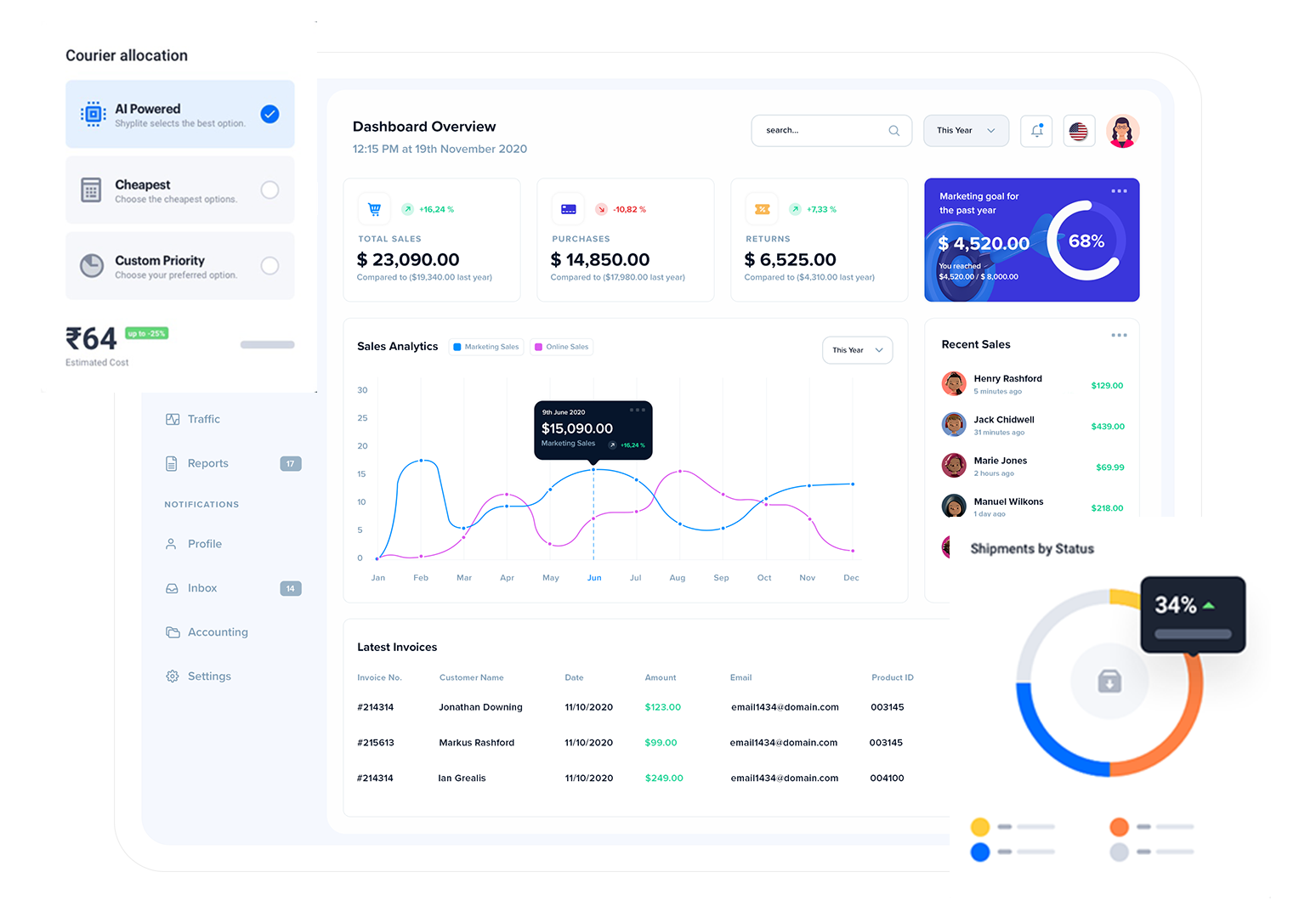

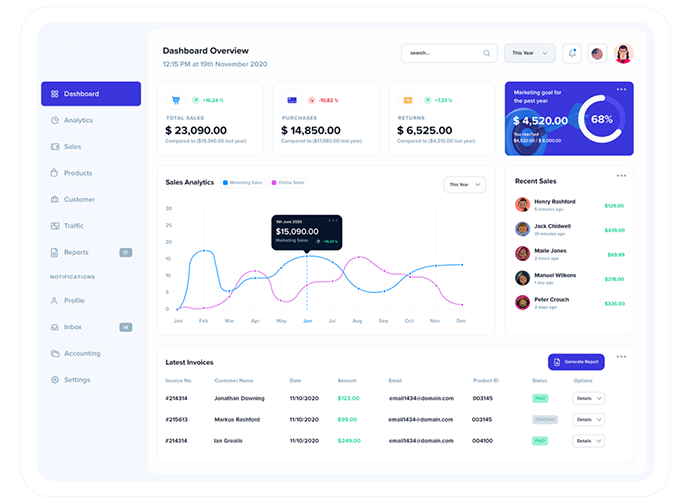

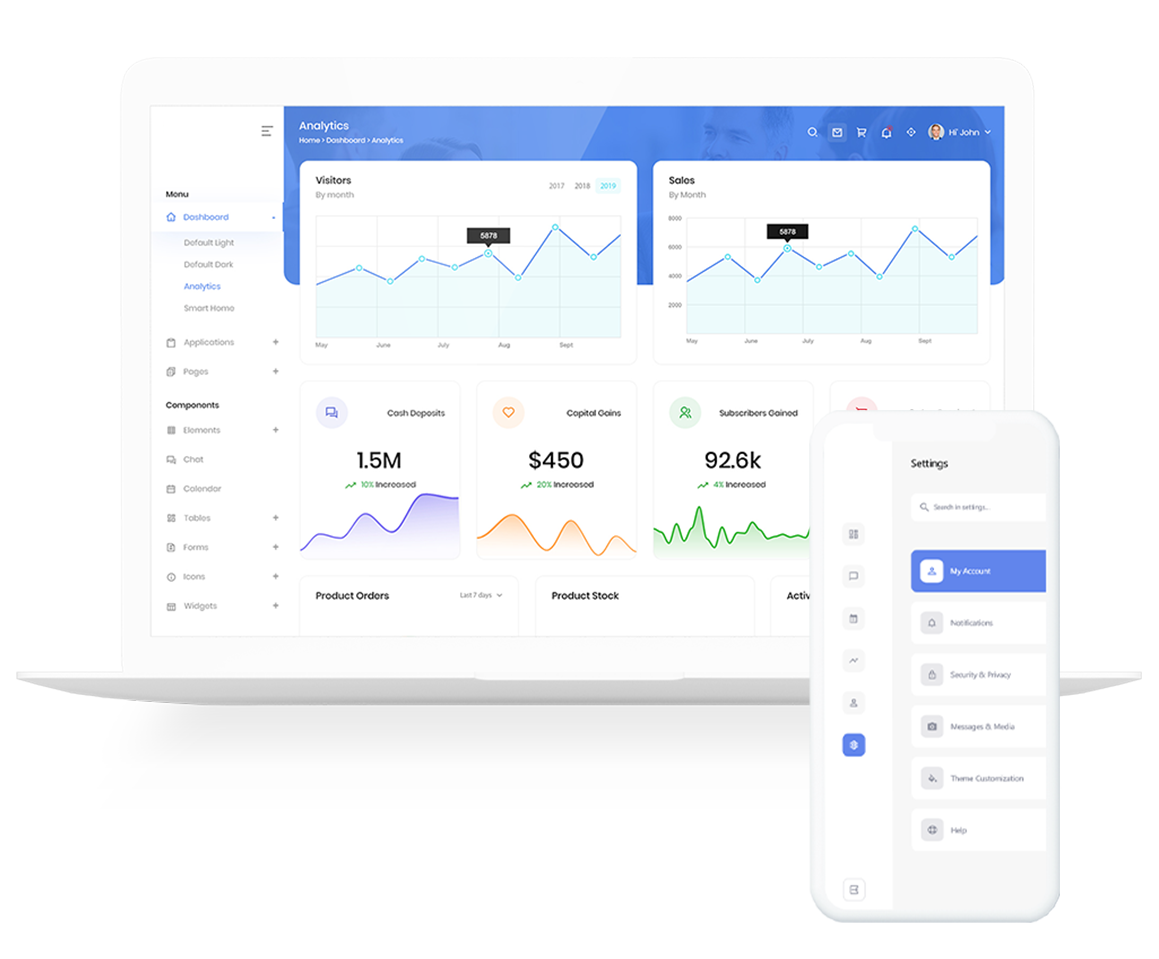

GBooks is one of the fastest growing and most user-friendly online accounting tool. It enables you to manage inventory, track spending, and make beautiful invoices without having any accounting experience.

Your accountant can readily receive the transactional data. With a few clicks, you can quickly learn what is happening with your company and improve your decisions.

Stop chasing following clients

Handle Timelines Effectively

Dedicate a specific number of hours to your client’s retainer and schedule work against that amount at a pace that works for both you and your client.

Create Professional Reports

Generate and send retainer summary reports at any point during a retainer period to keep your clients happy and informed.

Simplify Your Workflow

With this single, simple solution, recurring billing, time tracking, project management, and reporting work together flawlessly.

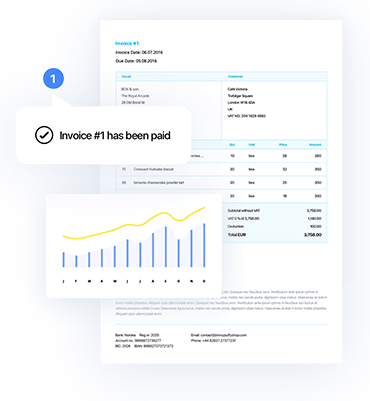

Professional Looking Invoices

Generate professional invoices easily by inputting client details, itemized products/services, costs, taxes, and payment terms. The software often allows customization of invoice templates to match your brand.

Creating professional-looking invoices is crucial for your business's image and helps ensure timely payments from clients. Here are some tips to make your invoices appear polished and credible: Header: Include your business logo, name, contact details, and an invoice number with the invoice date. Client Information: List the client's name, address, and contact details accurately. Itemized Charges: Create a clear table listing products/services, quantities, unit prices, and total amounts.

TRY IT FREE

Customizable Invoice Template

Create your own invoice template or Select the Invoice templet with Multiple Theme Options. Download in PDF or send an email to a client.

A customizable invoice template is a pre-designed document that businesses can tailor to their branding and needs. It allows for easy insertion of company logos, contact details, payment terms, and itemized charges. Customization options often include font styles, colors, and layouts, ensuring a professional and cohesive look for invoices. This flexibility saves time and maintains a consistent brand image while simplifying the billing process.

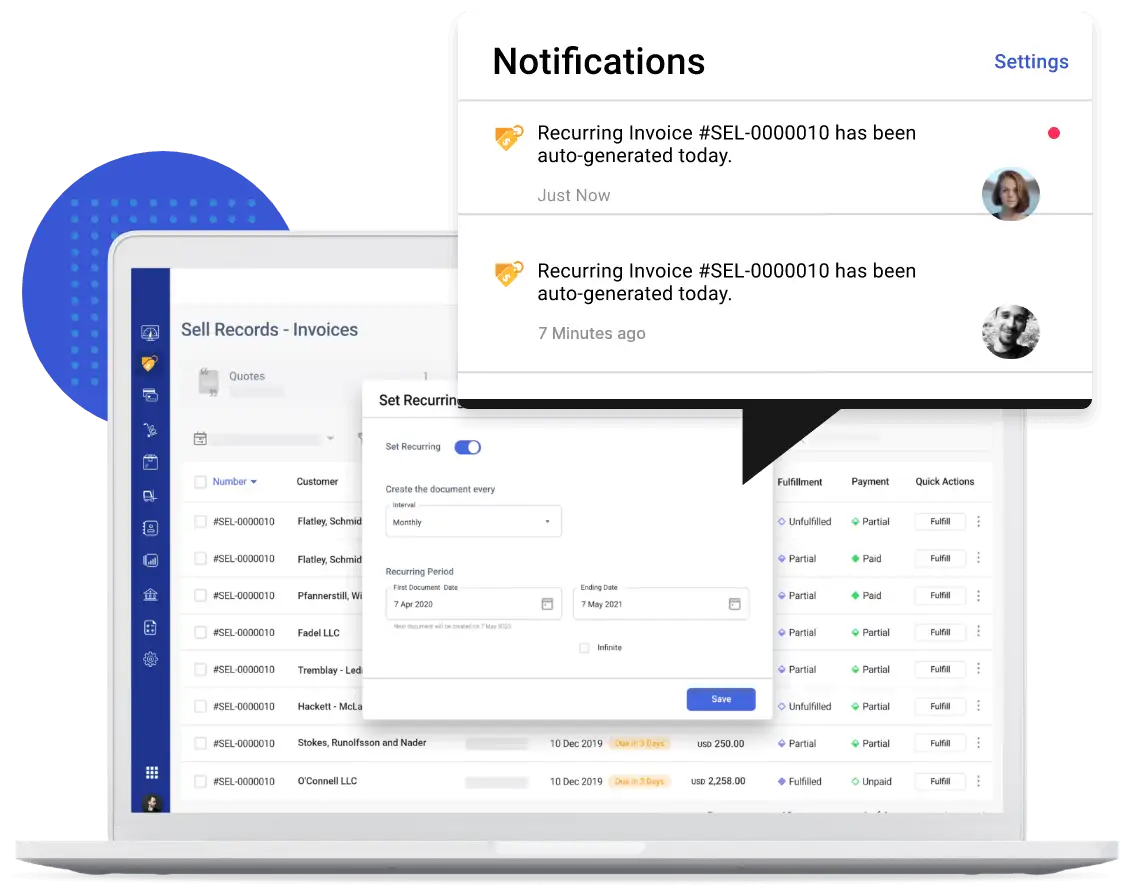

TRY IT FREERecurring Invoices

Generate professional invoices easily by inputting client details, itemized products/services, costs, taxes, and payment terms. The software often allows customization of invoice templates to match your brand.

Recurring invoices are automated billing documents that businesses create and send at regular intervals, such as weekly, monthly, or annually. They streamline the billing process, ensuring consistent revenue for services or products. These invoices typically include essential details like the invoice date, due date, itemized charges, payment instructions, and contact information for both the sender and recipient. Businesses often use accounting software to set up and manage recurring invoices, reducing manual work and improving financial efficiency.

TRY IT FREE

TAX Invoices

A tax invoice is a formal document provided by a seller to a buyer for the goods or services purchased, and it includes information related to the transaction and taxation. Tax invoices serve as an essential part of the accounting and tax reporting process for businesses.

Identification: Tax invoices typically include the seller's name, address, contact information, and often their tax identification number (TIN) or GST/VAT registration number. Invoice Number and Date: Each tax invoice should have a unique invoice number and an issue date. This helps in tracking and referencing the transaction. Buyer Information: The invoice should also contain the buyer's name, address, and any relevant tax identification details if applicable.

Tax invoices are crucial for businesses to account for sales revenue, calculate taxes owed, and comply with tax regulations. Buyers often use these invoices as documentation for expense claims or tax deductions. It's essential to ensure that tax invoices meet the specific requirements of your country's tax laws and regulations, as these requirements can vary widely from one jurisdiction to another.

Client Management

Maintain a database of client information, enabling easy retrieval of contact details, billing history, and other relevant data.

Client management involves building and maintaining positive relationships with clients. Key aspects in a few lines: Client Communication: Regularly engage with clients, listen to their needs, and provide solutions. Account Records: Maintain organized records of client information, interactions, and transactions.Service Delivery: Ensure prompt and high-quality service to meet client expectations. Feedback Loop: Seek client feedback for improvement and address any issues promptly. Client Retention: Develop strategies to retain clients and foster long-term partnerships. Data Security: Safeguard client data and respect confidentiality for trust and compliance.

TRY IT FREE

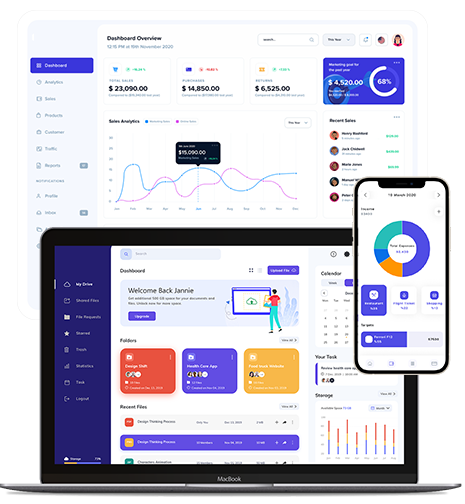

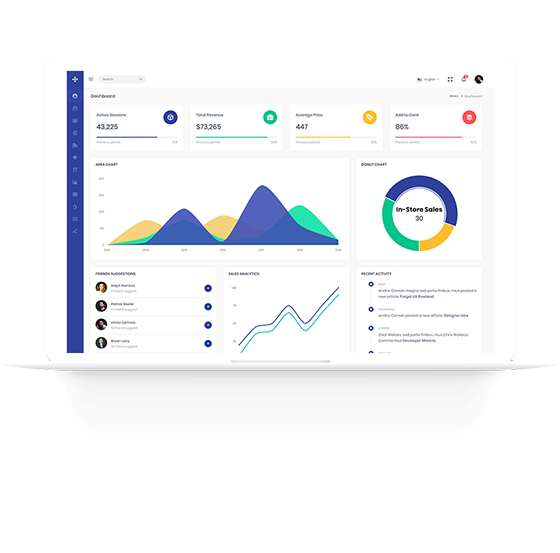

Access Anywhere

Remote Accessibility

Access data or services from any place with an internet connection. Convenience Enhances productivity and convenience for users on the go.

Device Compatibility

Works seamlessly on various devices like computers, smartphones, and tablets.

Cloud Services

Often facilitated by cloud-based solutions for universal access, Flexibility Enables work, communication, or entertainment without physical constraints.

Elevate your business with polished, professional invoices.

Frequently Asked Questions

Following details can be included in the Invoices

- 1. Your business name, address, Logo and contact information.

- 2. Client's name, address, and contact details.

- 3. Invoice number and date.

- 4. Description of products or services provided.

- 5. Quantity, unit price, and total amount for each item.

- 6. Any applicable taxes, discounts, or additional charges.

- 7. Payment terms and methods.

Payment terms specify when and how the client should pay. Common terms include "Net 15" (payment due in 15 days), "Due on Receipt" (payment due immediately), or other customized terms.

You can absolutely send electronic invoices. In fact, many businesses prefer digital invoices for their speed and environmental friendliness. You can download Invoice in PDF Format, send, and track electronic invoices generated.

If a client hasn't paid by the due date, send a friendly reminder. You may follow up with additional reminders mail and consider contacting the client directly to discuss the situation.

Yes, many accounting software and invoicing tools allow businesses to customize their invoices with their company logo, colors, and other branding elements. This helps reinforce brand identity and professionalism.