Free Accounting Software join now!

Bookkeeping and accounting services

Bookkeeping is the process of recording, organizing, and managing a company's financial transactions and activities. Bookkeeping software offers a range of features that help businesses maintain accurate financial records and ensure compliance with accounting standards.

Accurate bookkeeping is essential for making informed financial decisions, tracking income and expenses, managing cash flow, and complying with financial reporting requirements. It serves as the foundation for more advanced financial analysis and planning, including budgeting and forecasting. Many businesses and individuals rely on professional bookkeepers or accountants to maintain their financial records and ensure compliance with accounting standards.

Chart of Accounts

Set up and customize a chart of accounts to categorize and track various financial transactions, such as assets, liabilities, income, and expenses.

A chart of accounts (COA) is a structured list of all the accounts, categories, and classifications that a business or organization uses to record its financial transactions. It serves as the foundation for the accounting system and is essential for organizing and categorizing financial data accurately.

A well-organized and properly maintained chart of accounts is crucial for accurate financial record-keeping, financial analysis, compliance with accounting standards, and effective decision-making. It provides a structured framework for recording and reporting financial transactions, making it an essential tool in the world of accounting and finance.

TRY IT FREE

Double-Entry Accounting

Implement double-entry accounting principles to ensure that every financial transaction has equal and opposite effects on the relevant accounts.

Double-entry accounting is a foundational financial system where each transaction involves two entries: a debit and a credit, maintaining the balance of the accounting equation (Assets = Liabilities + Equity). Debits increase assets or expenses while decreasing liabilities or equity, and credits do the opposite. This method ensures accuracy, error detection, and compliance with accounting standards.

It enables the creation of key financial statements, including the balance sheet and income statement, providing a clear view of an entity's financial health. Double-entry accounting is the basis for accrual accounting, capturing transactions when they occur, not just when cash changes hands, leading to more accurate financial reporting and decision-making.

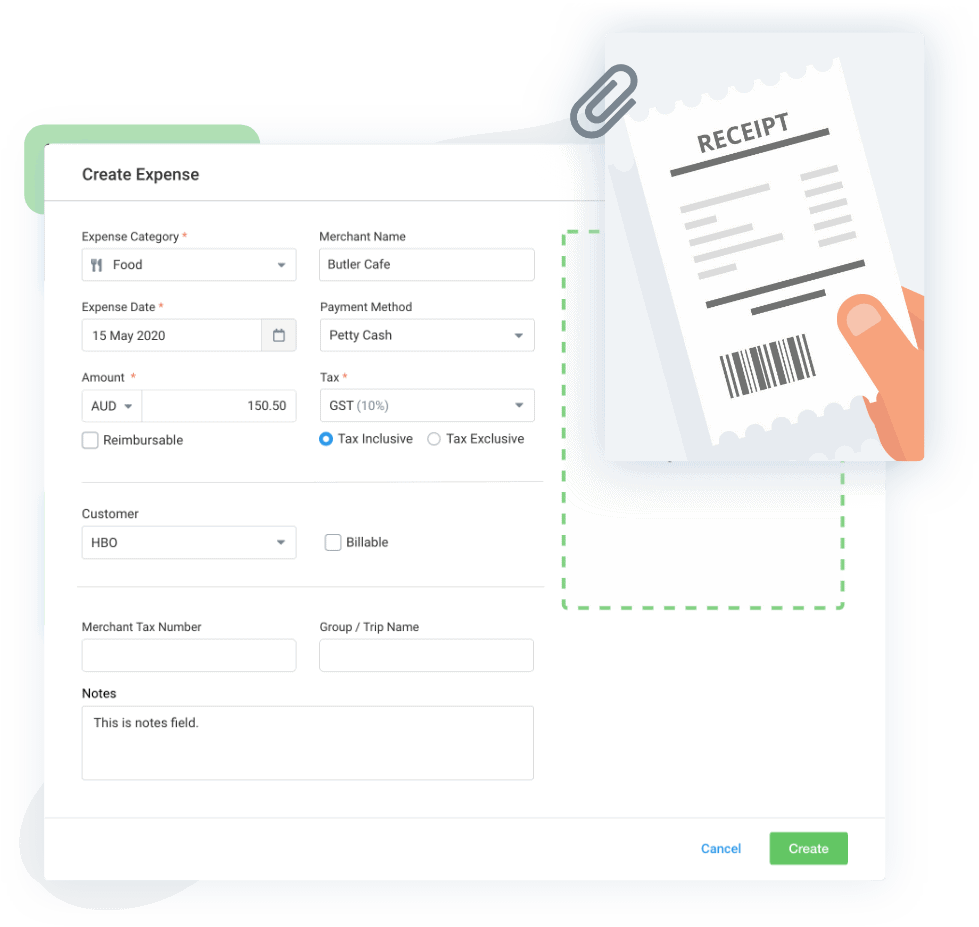

TRY IT FREEIncome and Expense Tracking

Record income and expenses associated with business operations, allowing for accurate profit and loss reporting.

Income and expense tracking involves systematically recording and monitoring financial transactions for individuals or businesses. It helps assess financial health, budget effectively, and make informed decisions. Income includes earnings like wages or investments, while expenses encompass spending such as bills and purchases. Tracking allows for expense categorization, ensuring prudent financial management. Digital tools and apps simplify this process, providing real-time insights and helping maintain financial stability.

TRY IT FREE

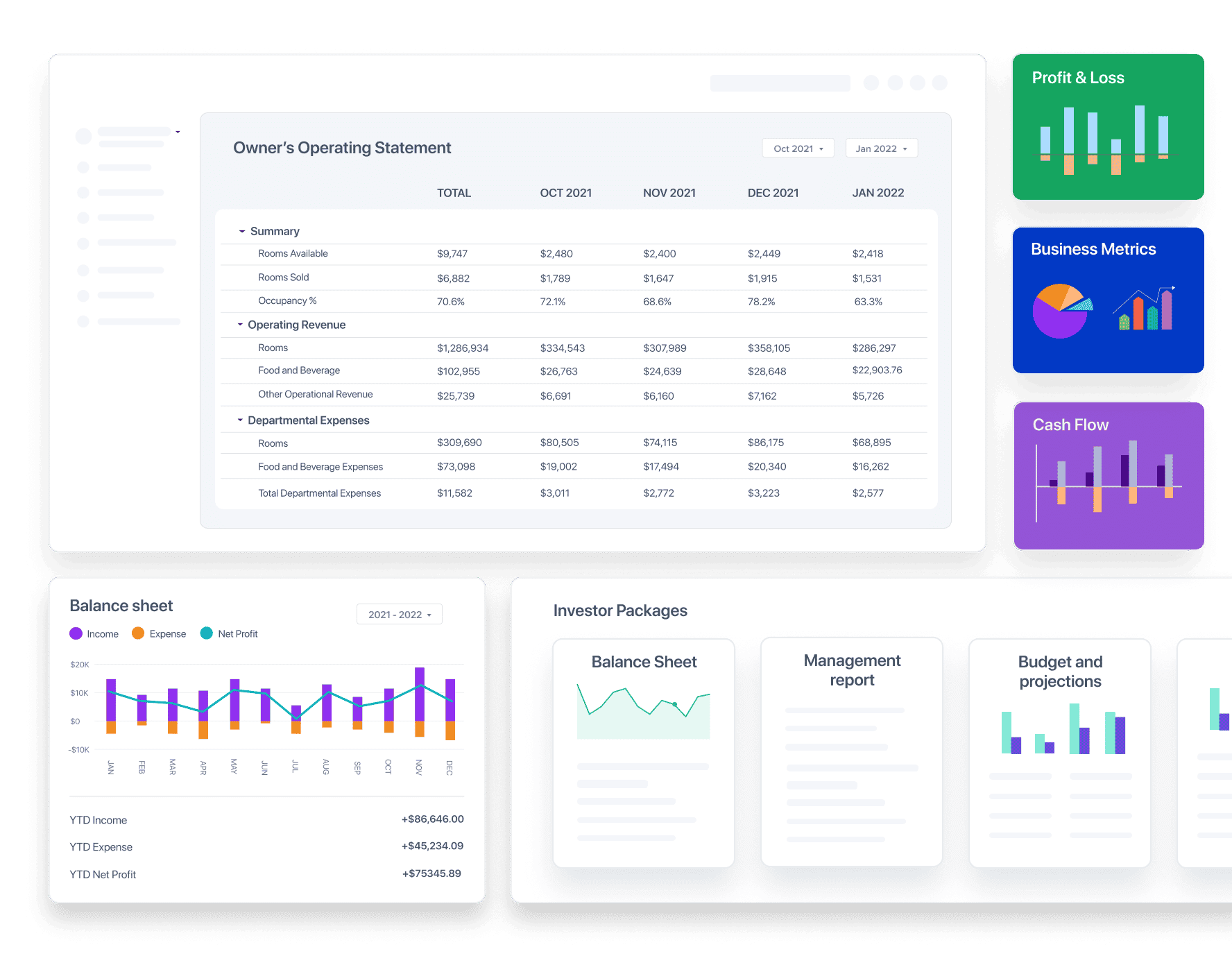

Financial Statements

Generate financial statements, including balance sheets, income statements, and cash flow statements, to assess the company's financial health.

Financial statements are formal records summarizing an organization's financial transactions and performance over a specific period, typically a fiscal quarter or year. These statements provide crucial insights into the financial health, operations, and profitability of a business or entity.

Financial statements are crucial for various stakeholders, including investors, creditors, management, and regulators, as they provide valuable information for decision-making, financial analysis, and assessing the overall financial health of an organization. These statements are typically prepared in accordance with accounting principles and standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), to ensure consistency and comparability across different entities.

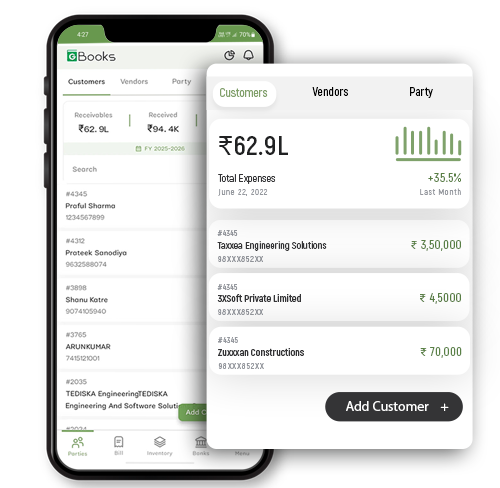

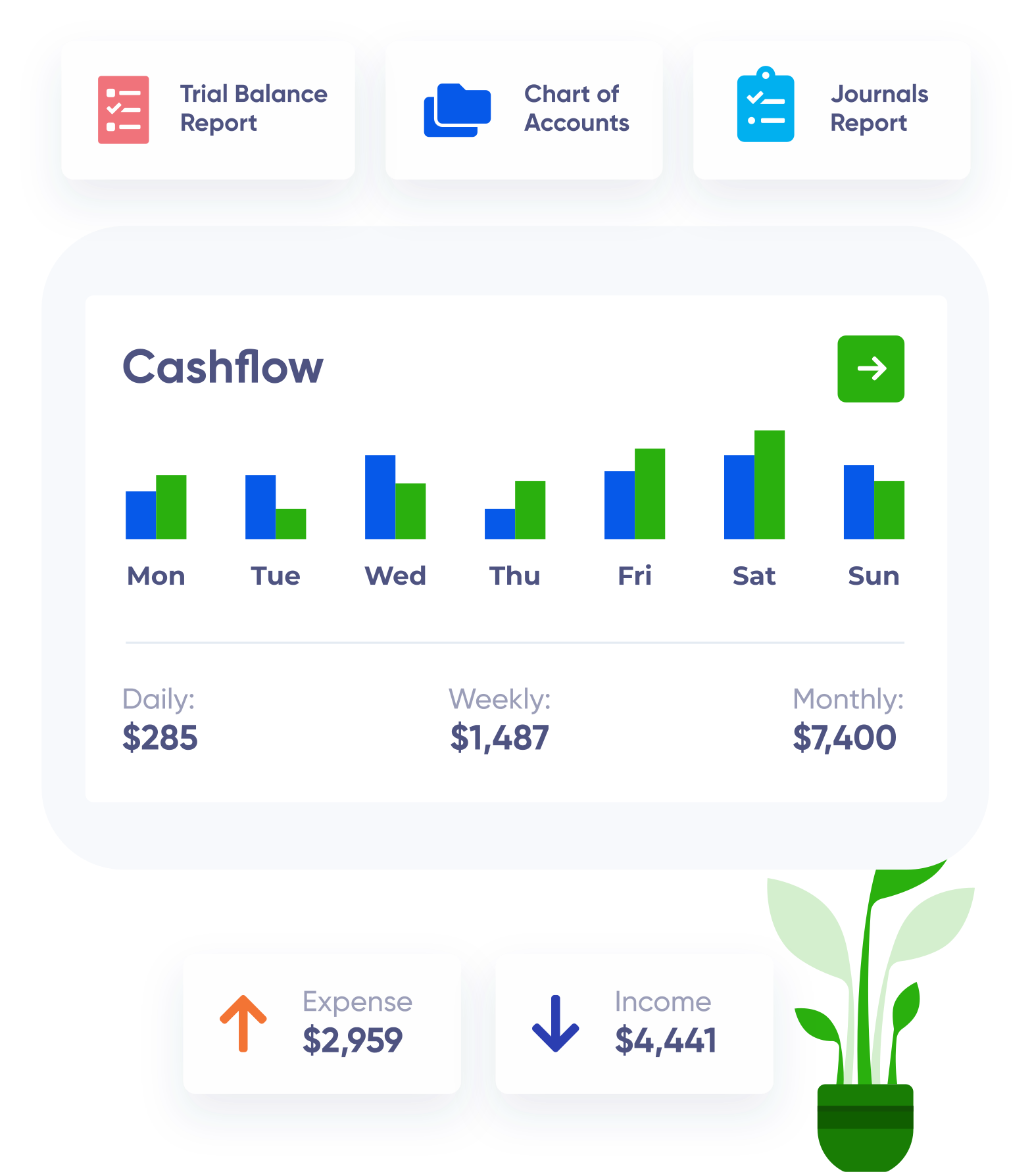

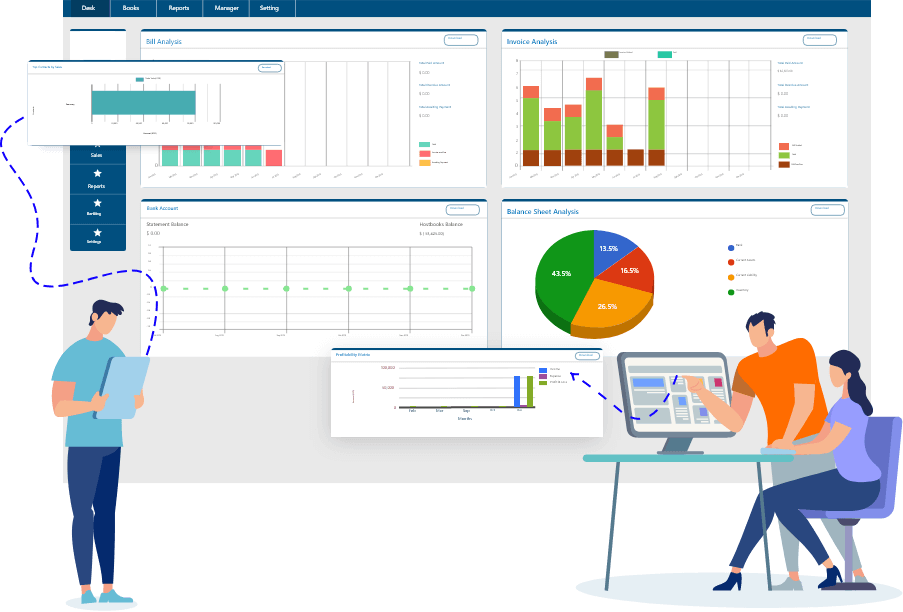

Accounting All in One Place Dashboard

GBooks has lots of reports to give you an overview of your company’s financial health on Dashboard Our detailed reports like balance sheet, profit & loss, trial balance, aged debtors and creditors help you to manage your finances. You can create comparison reports between any periods to see how your business is performing over different period of time.

Data Integration

All-in-one dashboards consolidate data from multiple sources, providing a centralized view.

Real-time Insights

Users can access up-to-date information and analytics at a glance.

Efficiency

Streamlines decision-making and monitoring by eliminating the need to navigate multiple systems.

Customizable

Dashboards can be tailored to display specific metrics or KPIs based on user preferences.

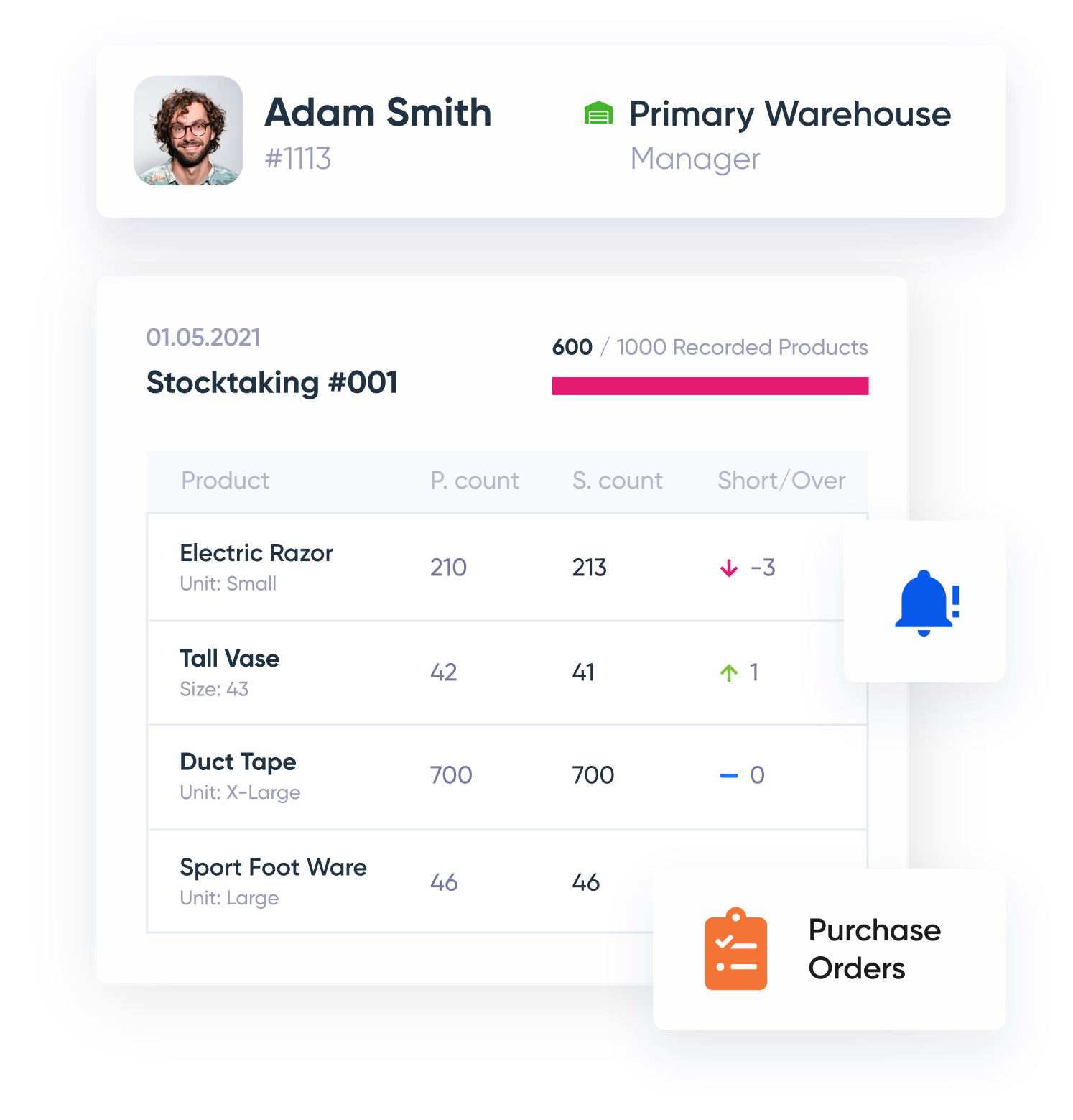

Transaction Reports

Transactions reports made it easy for you to look for any particular transaction or filter transactions for particular account to check total balances

Transaction reports are detailed records that provide comprehensive information about individual financial transactions within a business or organization. These reports are crucial for tracking and analyzing financial activities, ensuring accuracy, and making informed decisions.

Transaction reports play a critical role in financial management, accountability, and decision-making within organizations, providing a detailed record of financial activities that can be used for analysis, auditing, and financial planning.

Bulk Upload

Using bulk uploads is an efficient way to update the huge number of transactions. This feature saves you time by allowing you to download template spreadsheet reports, make line-item changes offline, and then upload those changes back into your account.

A customizable invoice template is a pre-designed document that businesses can tailor to their branding and needs. It allows for easy insertion of company logos, contact details, payment terms, and itemized charges. Customization options often include font styles, colors, and layouts, ensuring a professional and cohesive look for invoices. This flexibility saves time and maintains a consistent brand image while simplifying the billing process.

TRY IT FREE